On a Budget: Recovering from Financial Crisis

by Stephanie Koathes Sep 2, 2019

Even the best laid financial plans and intentions can be thrown off course by disasters that come out of nowhere. Maybe you fell ill, needed surgery, had a car accident or had to deal with some other costly incident. It’s stressful to deal with a financial disaster, but you can recover.

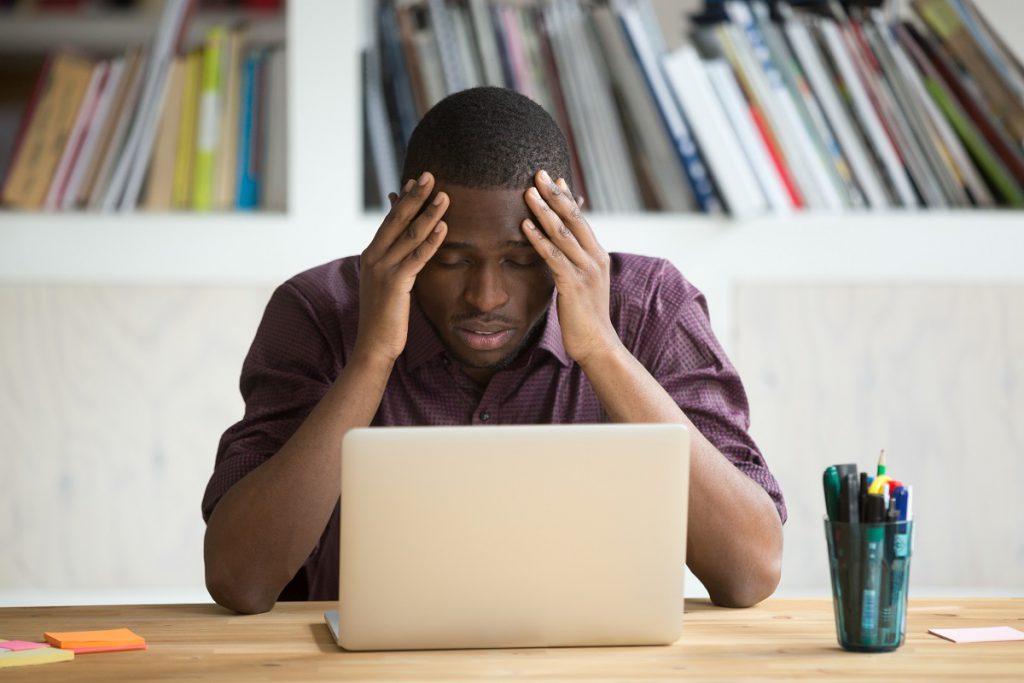

Accept the situation

Dealing with a financial setback can leave even the most positive people feeling depressed and anxious. However, the first step on the road to recovery is to stop wallowing in the misery and accept the situation. Don’t dwell on what you could have done differently. The more energy you spend thinking about the past, the less you have to focus on your recovery.

Write things down

Create a written financial plan. Note what you have, as well as every dollar that you spend. Knowing where your money is going will help you to make better decisions going forward. A good plan will help you to build your savings back up slowly. Don’t be afraid to ask for help with your plans.

Trim

On the road to financial recovery you will need to think about your needs versus wants. Trim the things that aren’t essential and use that money towards those that are. One of the most important steps in financial recovery is to recognise your new spending reality.

Know what you owe

If you find yourself owing money after suffering a financial setback, you need to take stock of what exactly you need to repay. Determine a total for your bills and how much you will need to pay monthly to gradually pay off the debt. If you’re unable to meet the minimum payment for some bills, get in touch with your creditors to see what payment options are available.

Don’t beat yourself up

It makes no sense to add to an already uncomfortable situation by being too hard on yourself. Yes, there are things you could have done differently, but there’s no way to avoid all of life’s curveballs. Have a plan, be responsible, and be kind to yourself.

Sources: Financial Mentor, Forbes, Huffington Post