Tips You Can Use to Avoid Getting Scammed While Shopping This Black Friday

by Carolyn Lee Nov 21, 2022

Grocery shopping, gift shopping, bill payments, and money transfers are just a few of the expenses that we’ve added to our budget for the upcoming Black Friday deals.

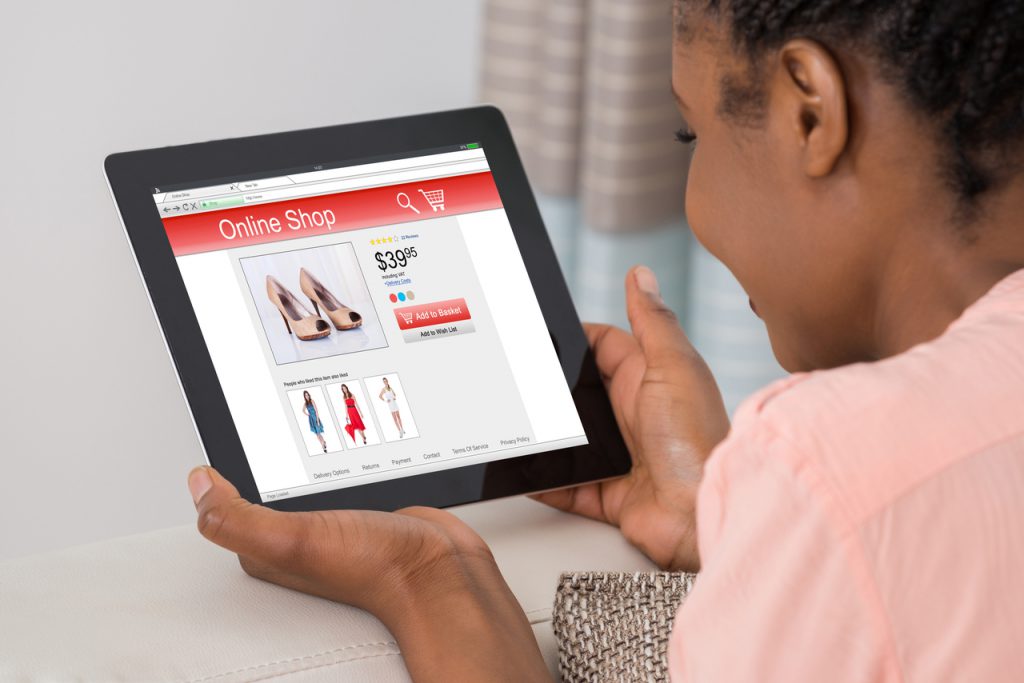

Some of us have already made plans to head to our favourite local stores and check out a few online sales.

Whether you are shopping at a physical location or online via an e-commerce website, we have a few tips you can use to protect against fraud.

- Turn on the notifications on your bank cards. Your bank will alert you via text or email of purchases made using your card. You can track spending and have a clear idea of what your balance is.

- Protect your bank card PIN when using it in public. Pay attention to your surroundings. Compare card payment and the printed bill to ensure both figures match.

- Review passwords and update, if needed. Don’t use the same password for several accounts (bank, Amazon, email, PayPal, etc.). Use passwords that are long and include upper and lowercase letters, symbols, and numbers. Use the authentication features to add even more security to your accounts.

- Call your bank immediately if you notice suspicious activity on your account. Avoid waiting for a day or two to sort it. If your account is compromised, they can make several purchases within a few hours or less. They can also empty your accounts.

- Ensure the website is secure before making purchases online. The URL should begin with “https://” with a small lock icon to confirm it’s a secure website. You can also use the “contact us” page to verify how best to contact them. There should be more than one method of getting in touch with the company. Most companies are on social media, so you can also review their comment section.

- Look out for scams. Shop online or on social media with companies you trust. Use a credit card instead of your debit to make purchases. Credit cards have security features that a debit card doesn’t. If hacked, it is easy to lock the card to prevent further fraud. Plus, the chance of you getting your money back faster is higher, and the process may be less time-consuming.

- Check your receipts before leaving the business place. Checking a long bill may seem tedious, but so is returning to the store to rectify missing items or issues like being overcharged.

- Avoid using public Wi-Fi for online shopping. Hackers can easily access your device while you are on a public network. Do not click on embedded hyperlinks in emails that offer deals. Instead, go to the company’s website directly.

- If a deal appears too good to be true, it probably is. Some businesses will have massive sales but go to the physical location or their official website. Before making purchases, compare the quality, quantity, and price of the item to other retailers. A noticeable disparity in the amount or prices could signal a scam.

It’s easy to lose track of our spending with the series of ongoing sales. However, monitoring our expenditures requires diligence, as scams and credit card fraud are prevalent.

When you use our Find Yello listing to locate businesses near you, you can read reviews on those businesses, view their official websites, and contact them using several methods (email, call, WhatsApp text, social media, etc.). We hope these tips help. Good luck!

Sources: Commerce Bank, Real Simple, Next Advisor, FICO and Lifelock.