On a Budget: Budgeting for the Holidays

by Stephanie Koathes Nov 4, 2019

The holidays are coming up fast. While it’s a fun time full of family, friends, and events, it’s also a stressful time for your finances.

With a little preparation and thought, however, you can prevent overspending and having an empty bank account in January.

Here are a few simple tips to help you with budgeting for the holidays.

• One of the first things you should do to ensure you use your money wisely over the festive season is to list your holiday expenses. Gifts, wrapping paper, holiday travels and events, office presents, outfits, food, decor – everything adds up. When thinking of holiday expenses, people tend to focus on gifts, but we end up spending on a lot of other items.

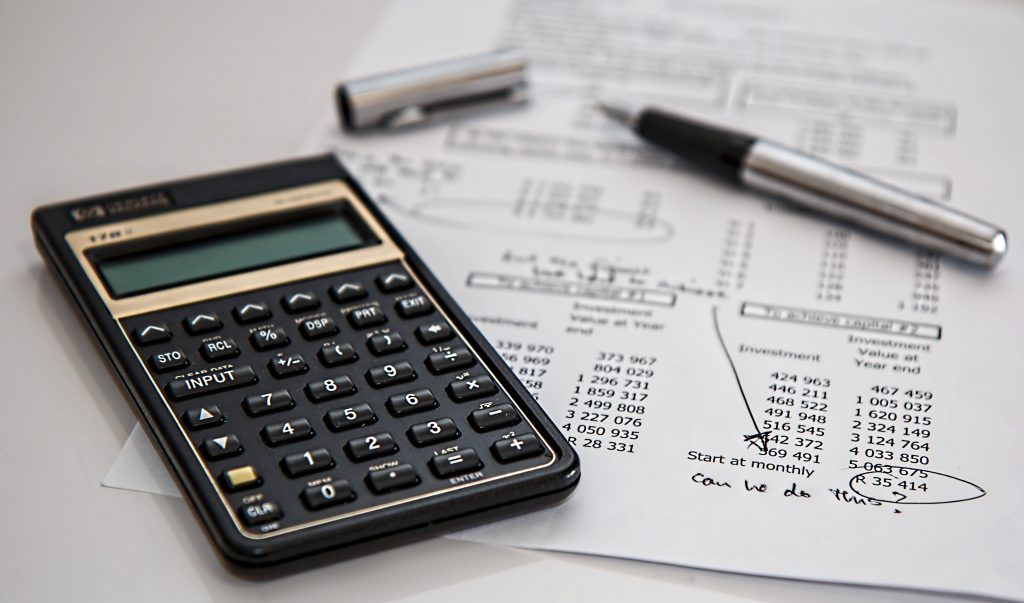

• After you’ve made your list of holiday costs, it’s time to determine your holiday budget and the amount you can allot to each category. Take stock of your finances. What are your overall expenses throughout December and January? Where do you stand with your credit card, loans, etc? This will help you to decide how much you can afford for various holiday expenses.

• Create a Christmas gift budget. List all the people you need to buy gifts for and using your overall holiday budget, determine a cost limit for each person. If you have a large family, you’ll want to make the individual limits lower. Consider making gifts for some of the people on your list or propose no-gift policies with some friends and extended family members.

• When you’ve determined your holiday budget, consider using cash to pay for these expenses. It’s easy to go overboard when paying with your credit card. Keep some money for each category and for each person you’re buying gifts for in labelled envelopes and use only this cash to pay for items.

• Start gift shopping early. One of the quickest ways to overspend is by leaving things to the last minute. Shop early and take advantage of sales such as Black Friday and Cyber Monday. Keep a list of who you’ve bought gifts for and check people off as you go along.

• If you can, save for the holidays throughout the year. Long-term saving for the holiday season will give you a lot more wiggle room and make it easier on your wallet when the time comes. Think about creating holiday savings account that you add to over the year, preferably one with high interest.

Enjoy the holidays!

Sources: The Balance, Money Under 30, Mental Floss, Better Money Habits, The Penny Hoarder